Open Loop Networks: How Stablecoin Payments Can Reach $190 Trillion Volume

Closed networks in crypto has hard ceilings and limits the industry

In the crypto ecosystem, stablecoins have been a remarkable success story, with on-chain transaction volume reaching $6.7 trillion over the past 12 months according to VISA's blockchain analytics. Yet paradoxically, their actual use for everyday payments remains minimal. The vast majority of stablecoin volume today serves crypto trading rather than commerce - they function primarily as the "common currency" of exchanges rather than as tools for daily transactions.

Most successful businesses built for actual stablecoin payments like Bridge operate as aggregators between the open loop crypto world for what amounts to simple transfers between fiat and stablecoin accounts. When it comes to actual payments they rely on existing payment networks, as seen in the latest announcements from Stripe, VISA, and Bridge.

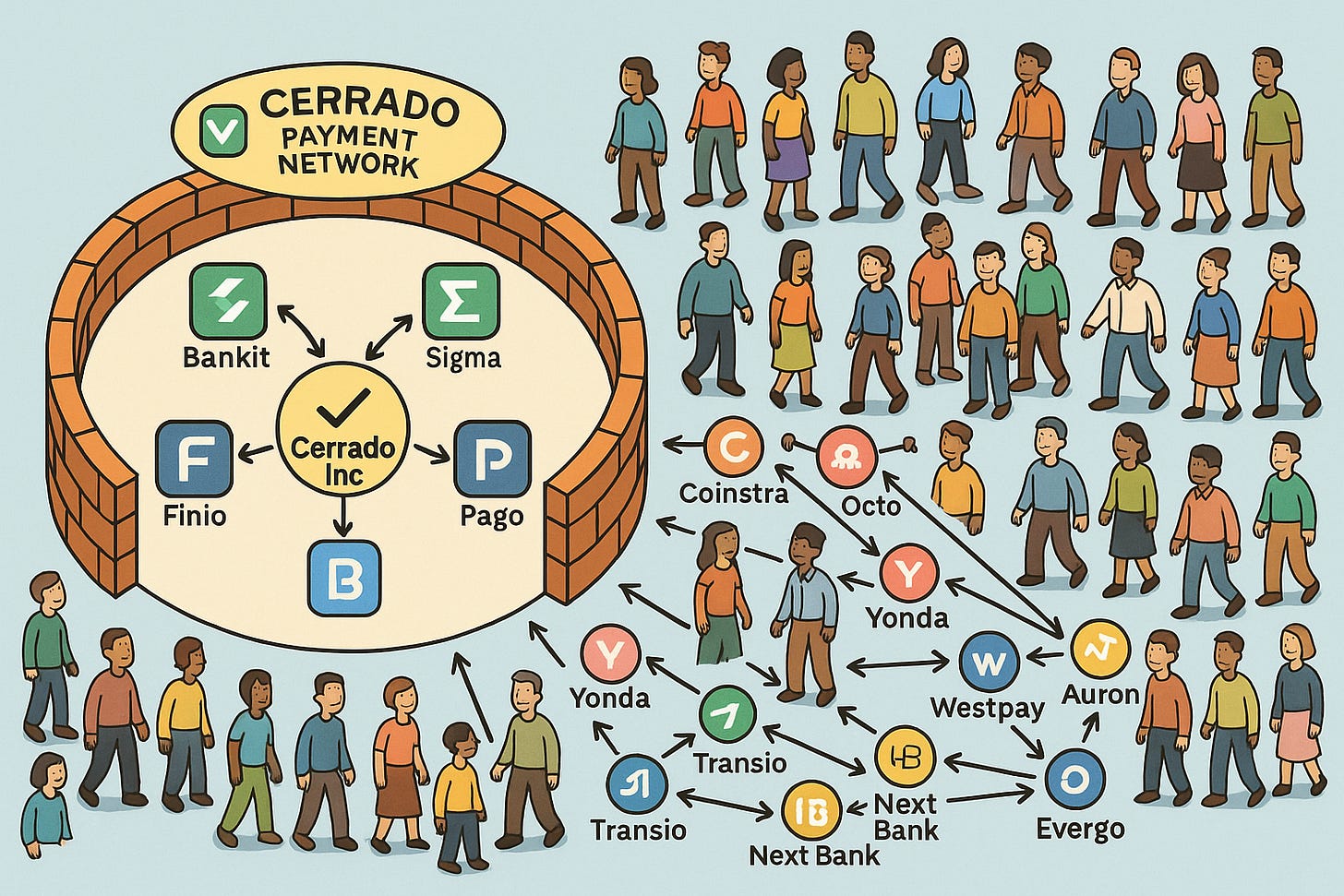

There is an emerging group of so-called “stablecoin sandwich” payment networks that when launched will operate largely as a collection of "closed loops" - siloed ecosystems where users can transact only within the boundaries of a specific platform or exchange. While admirable in their ambition to grow the usage of stablecoins as a cross-border settlement system, there are hard limits on the potential reach.

This mirrors the early internet era of AOL and CompuServe, where users could only interact with others within their chosen walled garden. Despite the inherently open and permissionless nature of blockchain technology, we've recreated the very centralized structures crypto was designed to transcend.

As I noted last week, the crypto industry is still in many ways stuck in 1996 - we have the technology but lack the interoperability standards and network effects that would unleash its full potential. We've built the infrastructure but have yet to tear down the walls between systems.

The Hard Ceiling of Closed Loops

To understand the limitations we face, we must first distinguish between closed and open-loop payment networks.

Closed-loop payment networks are environments where transactions can only occur between participants within a single system. Think of store credit cards, in-game currencies, or PayPal in its early days. These systems are controlled by a single entity that sets the rules and limitations. In crypto, most exchanges function as closed loops - you can only trade funds with other users within the same platform without friction.

Open loop networks, by contrast, allow participants to transact with any other participant, regardless of which provider they use. Traditional financial systems like Visa, Mastercard, and SWIFT are often cited as examples. However, it's important to note that while these networks are "open" in terms of their scale and reach, they still operate as centralized gatekeepers with a single controlling entity and a common rulebook that all participants must follow. They're "open" relative to entirely closed systems, but still fundamentally controlled environments.

The economic distinction is stark: closed loops can process a few trillion dollars annually, but cannot likely reach the $190 trillion goal the industry should be targeting. The global payments market is massive - encompassing retail, business-to-business, cross-border remittances, and more. Capturing even a fraction of this requires truly open systems that can connect diverse participants.

The comfortable trap many crypto companies fall into is building isolated yet profitable payment islands such as the aforementioned stablecoin aggregators and the new batch of closed networks. These can be substantial businesses in their own right, but they set the industry back from reaching its full potential. Each closed system fragments liquidity, user bases, and network effects.

Prime examples of this closed-loop approach are Coinbase's TRUST and Binance's GTR Travel Rule protocols. Despite being created to address regulatory compliance, these proprietary systems have caused massive issues for an industry trying to remain open while implementing compliant transfers. Instead of collaborating on common standards, these major players have built walled gardens that lock out competitors and fragment the ecosystem.

The risk for crypto is clear: if we focus on creating smaller versions of SWIFT or Visa, we're just creating worse and more limiting versions of the very gatekeepers our industry has always argued against. We'd be replicating the same centralized control structures but with less efficiency and scale - the worst of both worlds.

How the Internet Evolved from Walled Gardens

We've seen this story before. The pre-1996 internet was dominated by closed ecosystems like AOL, CompuServe, and Prodigy. These services offered curated content and communication, but only within their walled gardens. AOL, for instance, grew to over 25 million subscribers by providing a controlled online experience.

The paradigm shift came with open standards and protocols - HTTP for web browsing, SMTP for email, and critically, SSL for secure transactions. These technologies allowed any computer to connect to any other, regardless of service provider. The open web flourished, creating exponentially more value than the closed systems it replaced.

What happened to those early closed networks? AOL, despite its massive head start and user base, failed to adapt quickly enough to the open internet. By clinging to its dial-up and closed content model while the world moved to broadband and the open web, AOL saw its once-dominant position erode rapidly. By the time it tried to pivot, new leaders like Google had already emerged.

This pattern repeats throughout technology history: initial fragmentation and closed systems give way to standardization and interoperability, creating vastly larger markets in the process. From railroads to telecommunications to the internet, the story is consistent. Crypto payments are next in line for this transition.

TAP: Crypto's Open Loop Payment Network

Fortunately, the industry is developing solutions to enable compliant yet open payment networks. One key example is the Transaction Authorization Protocol (TAP) developed and donated as public domain by my company Notabene, which serves as a private multi-party transaction authorization layer handling complex real-world workflows on top of any public blockchain.

Both regulators and Virtual Asset Service Providers (VASPs) have been demanding an actual open protocol like SWIFT's ISO 20022 to support real-world payments use cases for public blockchains. TAP was built specifically in response to this feedback, designed from the ground up to be that missing standard.

By creating an open, interoperable framework modeled after proven financial messaging systems but tailored for blockchain's unique attributes, TAP addresses the fundamental need for standardization that the industry has lacked.

Unlike most attempts of the industry to create open and closed Travel Rule protocols, TAP like SWIFT and ISO 20022 is focused primarily on the payment and business use cases and adds Travel Rule as an optional feature.

Unlike simple payment protocols, TAP creates a secure messaging protocol where parties can exchange the necessary information to authorize and validate transactions before they occur on public blockchains. It handles the nuanced requirements of different jurisdictions, risk appetites, and transaction types, supporting various compliance workflows while preserving privacy for non-regulatory data.

TAP is designed for multi-party scenarios - not just sender and recipient, but also custodians, exchanges, PSPs, and other stakeholders that may need to participate in complex transactions.

By standardizing how these parties interact during the authorization process, TAP enables interoperability without sacrificing security or compliance.

Beyond TAP, other building blocks for open loop payments include:

Cross-chain bridges and liquidity protocols that enable stablecoins to flow between different blockchains

Next generation public blockchains like Concordium and Canton are creating safer ecosystems while remaining open.

Universal wallet standards like WalletConnect create consistent user experiences across platforms

Identity and compliance frameworks that satisfy regulatory requirements while preserving appropriate privacy

⠀Together, these technologies are creating the infrastructure for truly open stablecoin payment networks - systems where funds can flow as easily between different wallets and platforms as emails flow between Gmail and Outlook.

How Open Loop Stablecoin Payments Transform Finance

What becomes possible when stablecoin payments operate on open-loop networks with proper privacy and security layers? The transformation is profound, enabling use cases that closed systems simply cannot support.

For merchants, open networks mean accepting payments from any customer, regardless of which wallet or exchange they use. This dramatically expands their addressable market without requiring integration with dozens of disparate systems. A small business in Bangkok could receive payments from customers using wallets based in Brazil, Canada, or Nigeria - all settling nearly instantly and with minimal fees.

For consumers, open networks provide freedom of choice and seamless interoperability. They can select wallets based on features and user experience rather than which closed ecosystem has their favorite merchants or peers. Sending money internationally becomes as simple as sending a local payment, without the friction of currency conversion or correspondent banking delays.

For financial institutions, open networks create new opportunities to provide value-added services atop a standardized infrastructure. Instead of competing on basic payment functionality, they can differentiate through superior risk management, customer service, or complementary financial products.

The real-world applications are vast: global e-commerce without currency conversion costs, instant cross-border remittances, efficient B2B settlement, micropayments for digital content, programmable recurring payments, and much more. Many of these use cases require the network effects that only open systems can provide.

When we remove the artificial barriers of closed loops, the potential market expands dramatically. We move from the current trillion-dollar cryptocurrency market to addressing a meaningful portion of the $190 trillion global payments flow. This is the difference between creating a small handful of successful companies in a small pond and or transforming global finance as a whole creating opportunities for everyone.