Stablecoins need their SSL moment

Crypto remains stuck in the AOL era

The Plaintext Problem: Crypto's Fundamental Vulnerability

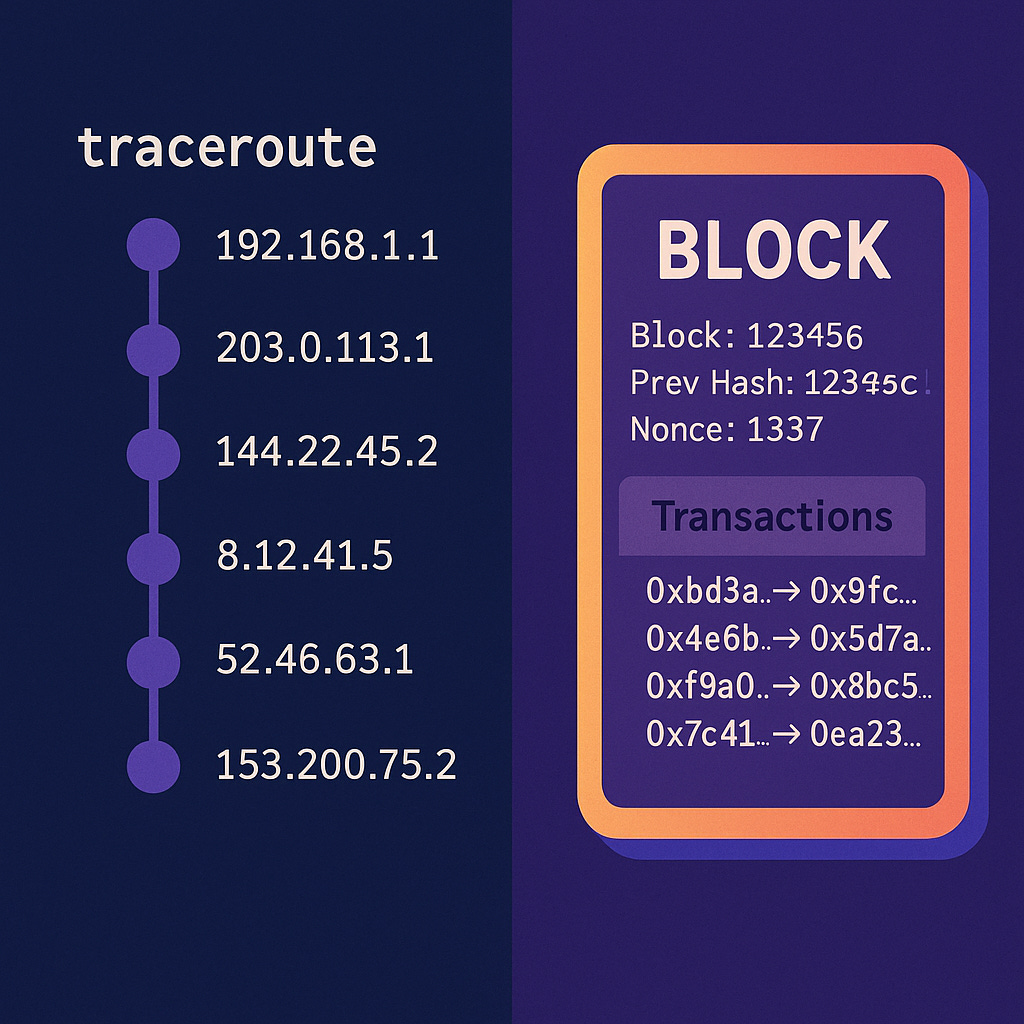

In the early days of the internet, data traveled in plaintext. Every packet, every message, every piece of information was visible to anyone who cared to look. This fundamental lack of privacy and security made e-commerce virtually impossible. Who would enter their credit card details when that information could be intercepted by anyone along the digital path?

The cryptocurrency ecosystem faces a strikingly similar problem today. Despite blockchain's revolutionary breakthrough in enabling decentralized consensus and ironically being based on cryptography, it has a critical design limitation: transactions on public blockchains are entirely visible to everyone, with no built-in mechanism to protect sensitive information.

When you send a transaction on most public blockchains, anyone can "view and verify the transactions that occur on the network" - creating transparency but also exposing every detail of your financial activity. Every amount, every sender address, every recipient address—all permanently recorded on an immutable ledger for anyone to see.

This isn't a bug but a feature of blockchain architecture. The radical transparency of public blockchains enables trustless verification but creates significant privacy concerns. Just as the early internet's plaintext communications hindered its development as a commercial platform, blockchain's built-in transparency creates barriers to mainstream adoption.

The Birth of Trust Layers

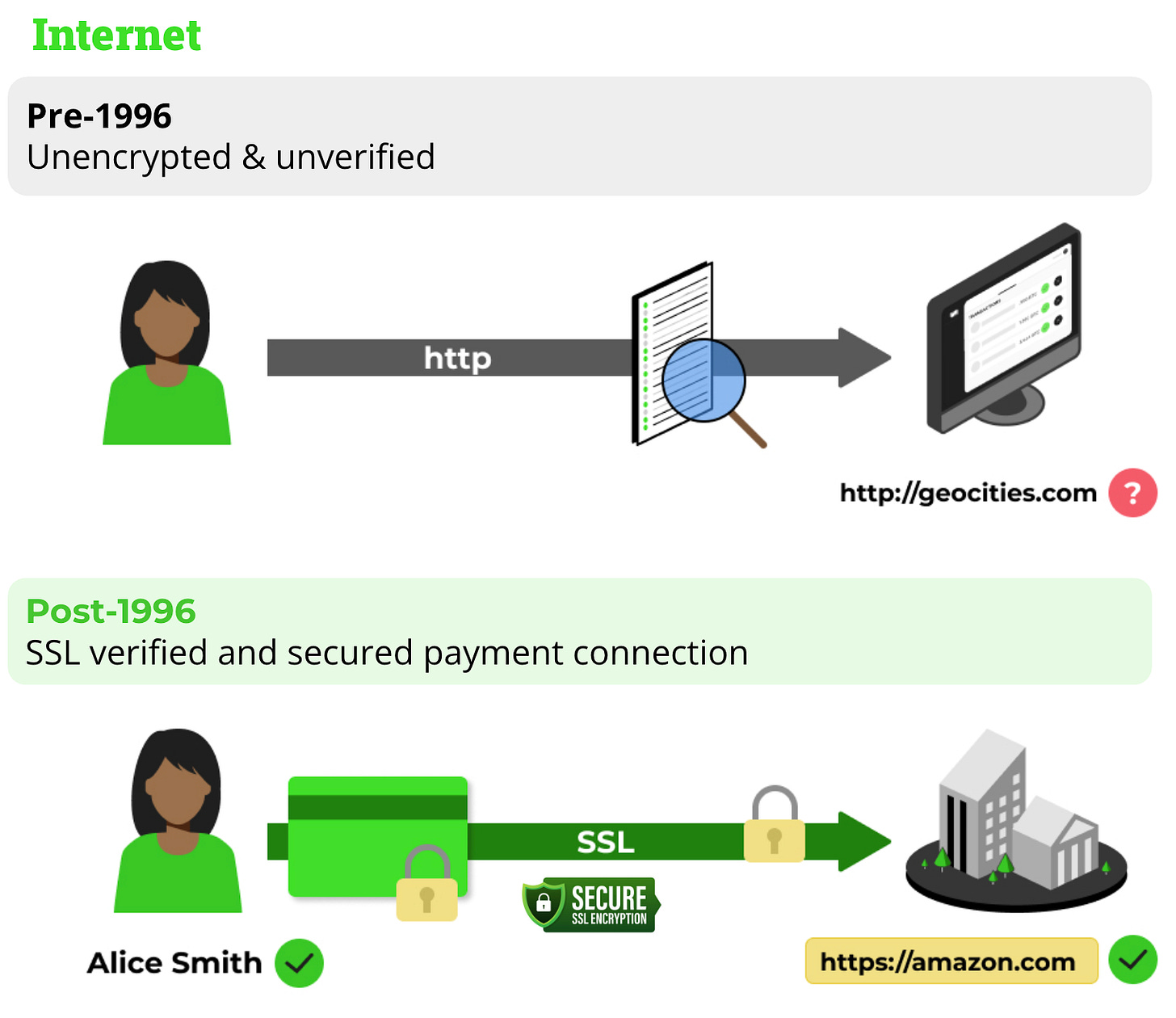

The internet's commerce problem was solved through the development of critical security protocols. In 1995, Netscape introduced the Secure Sockets Layer (SSL) protocol, which revolutionized how information was transmitted online.

SSL was first developed by Marc Andreessen and his team at Netscape in 1995 to ensure privacy, authentication, and data integrity in Internet communications. It created encrypted connections between users and websites, transforming "a garbled mess of characters" that would be "nearly impossible to decrypt" for anyone attempting to intercept data.

Before SSL, sending sensitive information online was like shouting your credit card number across a crowded room. After SSL, it was like passing a sealed envelope that only the intended recipient could open. This seemingly simple change enabled the e-commerce revolution and the transformation of the internet from an academic curiosity to a global economic engine.

The transition to encrypted web communications didn't happen overnight. In 2010, Google began offering encrypted search, but noted that "since SSL connections require additional time to set up the encryption between your browser and the remote web server, your experience with search over SSL might be slightly slower than your regular Google search experience." Despite initial performance concerns, the security benefits eventually outweighed the costs, and encryption became the default for online communications.

The emergence of SSL/TLS as a universal standard allowed the internet to evolve from walled gardens like AOL and CompuServe—where users sacrificed freedom for security—to the open, global network we know today. The protocol didn't replace the internet; it enhanced it with a critical trust layer that made secure commerce possible while preserving openness and innovation.

Blockchain's Missing Layer

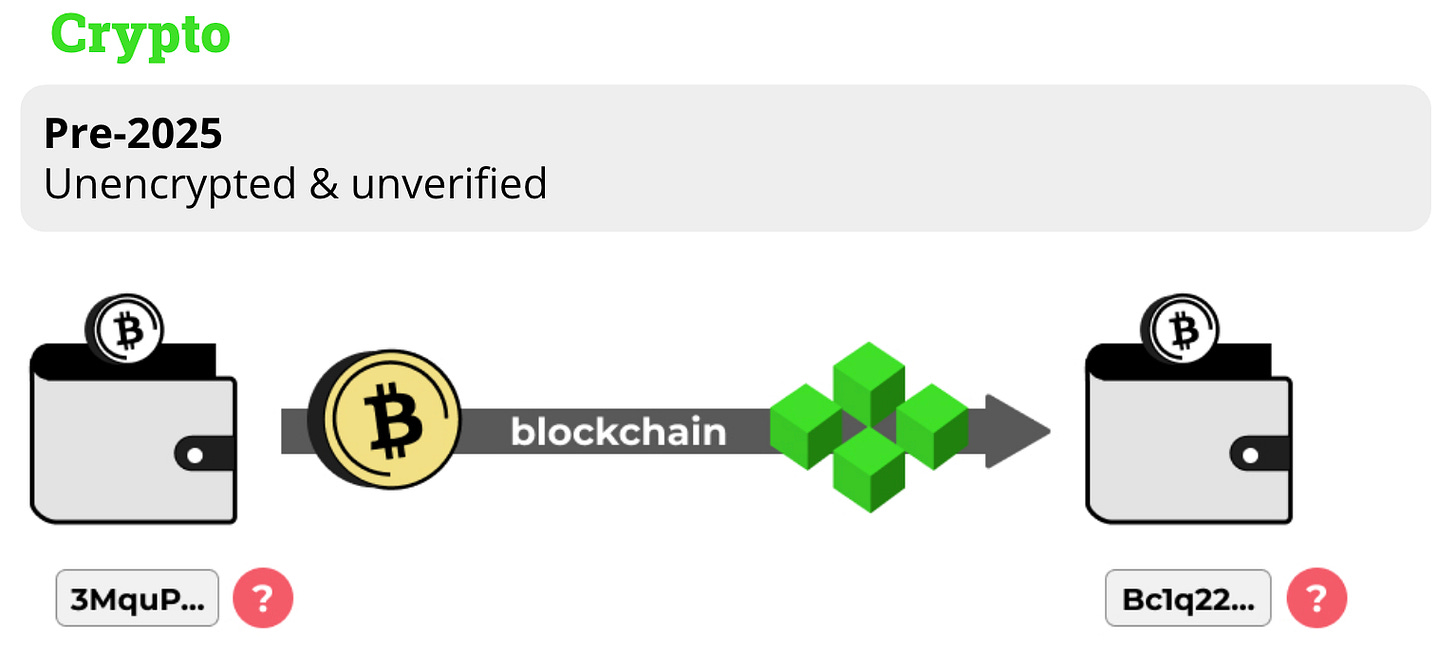

Today's blockchain ecosystems face a similar crossroads. The fundamental innovation of blockchain—a secure, decentralized ledger with immutable records—enables revolutionary new applications. However, its transparency creates privacy concerns that limit mainstream adoption.

Public blockchains expose transaction amounts and the addresses involved. If the address owners become known, the user loses their anonymity. This visibility makes public blockchains a prime target for hackers and thieves precisely because of their transparency.

Just as e-commerce couldn't flourish on an unencrypted internet, many real-world financial applications cannot thrive on completely transparent blockchains. Without a way to protect sensitive information, while maintaining the integrity of the ledger, users are forced to choose between privacy and decentralization.

This dilemma has led to the proliferation of centralized crypto services—exchanges and wallets that abstract away the complexity and privacy concerns of direct blockchain interaction.

A purely peer-to-peer version of electronic cash would allow online

payments to be sent directly from one party to another without going through a

financial institution. - Satoshi Nakamoto

These walled gardens, like Coinbase and Binance, offer a familiar, comfortable experience, but at the cost of the original payment use case of crypto and the very decentralization that makes blockchain revolutionary.

The reality is if you, like an estimated 65% of all crypto users, only buy, hold, and sell crypto you don’t need anything but a walled garden.

The parallels to the early internet are striking. Just as AOL created a controlled online environment that felt safer than the open internet, centralized exchanges create controlled blockchain environments that feel safer than direct interaction with public chains.

And just as the internet needed SSL to break free from walled gardens, blockchains, and in particular stablecoins need a privacy and identity layer to achieve their full potential as an open-loop payment system.

To be clear, I strongly believe Centralized institutions are key to driving the real-world adoption of crypto. I am primarily arguing that if we don’t solve this, crypto will never actually achieve its original use case of being an open-loop payment mechanism.

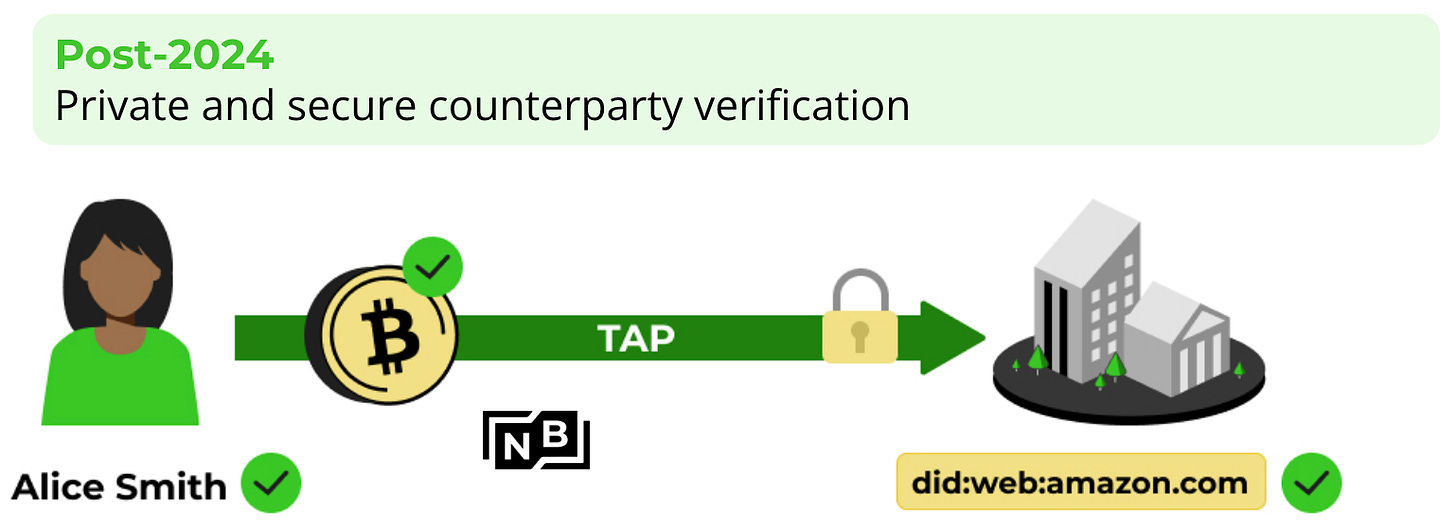

Enter TAP: The Transaction Authorization Protocol

The Transaction Authorization Protocol (TAP) aims to be for blockchain what SSL was for the internet—a critical trust layer that enables privacy and security without sacrificing the underlying benefits of the technology.

TAP creates a decentralized payment messaging protocol that connects real identities with blockchain transactions through several key mechanisms:

Human-readable transactions: Just as DNS replaced IP addresses with domain names, TAP can replace complex cryptographic wallet addresses with easily understandable payment requests from real-world identities.

Pre-transaction verification: Unlike traditional blockchain transactions where funds are sent irreversibly to addresses without verification, TAP enables communication between transacting parties before settlement, ensuring funds reach the intended recipient.

Privacy-preserving design: TAP connects real-world identities to transactions without exposing personal information on public blockchains, maintaining the privacy advantages of crypto, while allowing businesses to reconcile payments to their fulfillment and accounting systems.

Regulatory compliance: By facilitating information sharing between transacting parties, TAP helps meet requirements like the Financial Action Task Force (FATF) Travel Rule while preserving user privacy.

This approach tackles the fundamental contradiction at the heart of blockchain adoption: how to create private, secure transactions on inherently public, transparent ledgers. By adding a privacy and identity layer on top of existing blockchains, TAP aims to enable mainstream use cases while preserving the core benefits of decentralization.

The SSL Moment: From Encryption to Abundance

The introduction of SSL was more than a technical upgrade to the internet—it was a catalyst for an explosion of innovation and economic activity. Once users could safely transact online, e-commerce boomed, leading to entire new industries and business models. The ability to securely send and receive sensitive information transformed the internet from a communication network to the backbone of the global economy.

Crypto stands at a similar inflection point today. The technological foundation—decentralized, trustless consensus—is revolutionary, but without proper identity and privacy layers, its applications remain limited. Most users have only limited trading exposure to crypto through centralized exchanges but are not using it as part of their everyday lives.

The introduction of protocols like TAP will trigger a similar explosion of innovation by enabling secure, private transactions on public blockchains. Just as SSL enabled Amazon, eBay, and countless other e-commerce businesses, a robust identity and privacy layer for blockchain could enable new financial services, cross-border payment systems, and applications we have yet to imagine.