The Everyday Crypto Miracle

Maria sits at a sunny café in Barcelona, enjoying the morning breeze. When the barista brings her cortado, she simply taps her MetaMask card on the café's payment terminal. The barista smiles, the machine beeps approvingly, and the transaction is complete in seconds.

Just another ordinary card payment, except it's anything but ordinary.

What just happened represents one of the most complex intersections of financial technology ever created: a seamless bridge between the decentralized world of blockchain and the traditional financial system. Neither Maria nor the barista realizes that this simple tap triggered a remarkable 18-step journey that spans multiple technologies, companies, blockchains, banks, and payment networks.

Today, I'm taking you behind the scenes of what actually happens when you swipe a crypto card, following the journey of value as it transforms from USDC tokens on a blockchain to euros in a merchant's bank account.

Before the Journey Begins: Setting the Stage

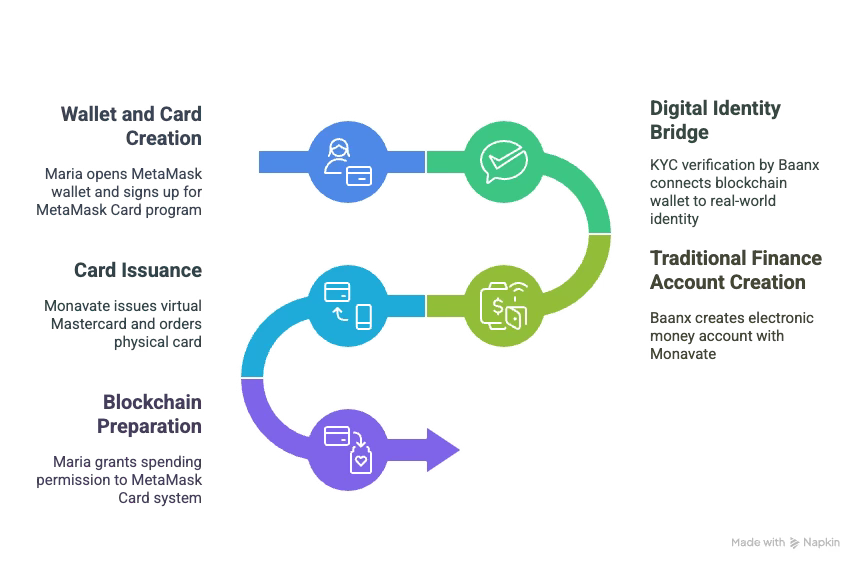

Before Maria could tap her card at the café, a complex setup process was required:

Wallet and Card Creation: Maria opened her MetaMask wallet app and signed up for the MetaMask Card program.

Digital Identity Bridge: Maria completed KYC (Know Your Customer) verification, providing her identity documents to MetaMask's partner Baanx, which verified her identity through specialized vendors. This crucial step connected her anonymous blockchain wallet to her verified real-world identity.

Traditional Finance Account Creation: Behind the scenes, Baanx created an electronic money account for Maria with Monavate, a regulated financial institution and Mastercard principal member.

Card Issuance: Monavate issued a virtual Mastercard number immediately, while ordering a physical metal card from CompoSecure, which manufactured and shipped the card to Maria's address.

Blockchain Preparation: Maria granted spending permission (allowance) directly to the MetaMask Card system using the built-in functionality of the USDC ERC-20 token on the Linea Layer 2 blockchain. This allowance mechanism, native to the token itself, serves as the secure bridge that connects Maria's crypto assets to the card payment system without requiring a separate smart contract deployment.

Now everything is in place for that fateful moment at the café.

The Tap That Launches a Thousand Processes

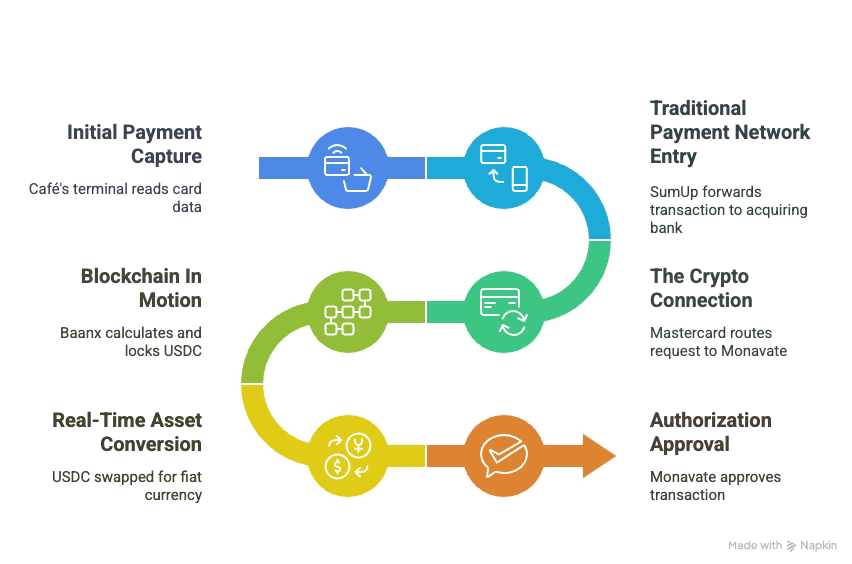

When Maria taps her card to pay €4.50 for her cortado, it instantly triggers parallel processes in two entirely different financial ecosystems:

Initial Payment Capture: The café's SumUp payment terminal reads the encrypted card data and sends it to SumUp's backend system. At this point, this looks like any other card payment. SumUp has no idea that cryptocurrency is involved.

Traditional Payment Network Entry: SumUp's system forwards the transaction to its acquiring bank, which submits an authorization request into the Mastercard network. This request says, "Someone wants to spend €4.50 at Barcelona Café, is this card good for it?"

The Crypto Connection: Here's where things get interesting. Mastercard routes the authorization request to Monavate's issuer-processing platform. Recognizing this as a MetaMask card transaction, Monavate's system immediately contacts Baanx.

Blockchain In Motion: Baanx's platform calculates the amount of USDC needed (perhaps $4.85 accounting for the EUR/USD exchange rate plus some buffer for fees). It then uses the spending allowance Maria previously granted to lock exactly that amount of her USDC, using the built-in functions of the ERC-20 token standard.

Real-Time Asset Conversion: The USDC token's allowance mechanism verifies Maria has sufficient funds and locks the USDC. Simultaneously, Baanx works with liquidity providers who immediately swap this locked USDC for fiat currency at the current market rate.

Authorization Approval: With confirmation that Maria's USDC has been locked and converted to fiat, Monavate approves the authorization. This approval travels back through the Mastercard network to the acquirer, then to SumUp, and finally to the terminal at the café.

The café's SumUp terminal displays "Payment Approved," and the barista hands Maria her cortado. All of this happened in just a few seconds.

Settlement: The Longer Journey

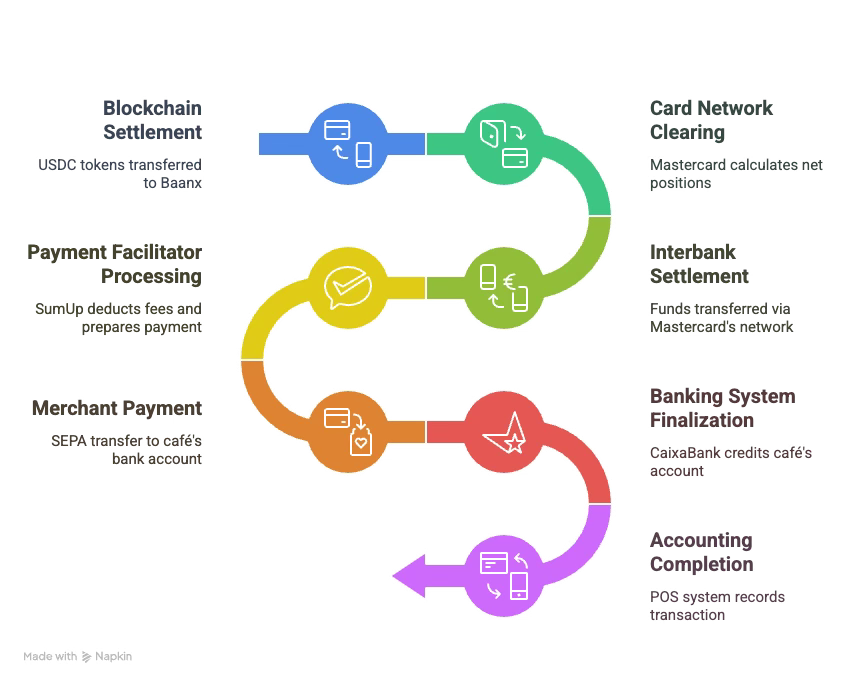

While Maria enjoys her coffee, the financial settlement process continues:

Blockchain Settlement: On the crypto side, the locked USDC tokens are now transferred directly from Maria's wallet to Baanx's control using the standard ERC-20 transfer function, completing the blockchain portion of the transaction.

Card Network Clearing: At the end of the business day, Mastercard's clearing process runs, calculating the net positions between issuers and acquirers. Monavate (the issuer) now owes the acquirer approximately €4.39 (€4.50 minus Mastercard's interchange fee).

Interbank Settlement: Typically one business day after the transaction (T+1), Monavate's settlement bank transfers the funds to the acquirer's settlement bank through Mastercard's settlement network.

Payment Facilitator Processing: SumUp receives the funds from its acquiring bank, deducts its own fee (perhaps 1.5%), and prepares to pay the café.

Merchant Payment: SumUp initiates a SEPA (Single Euro Payments Area) credit transfer to the café's bank account at CaixaBank.

Banking System Finalization: CaixaBank receives the SEPA transfer and credits the café's account with the final amount (around €4.28 after all fees).

Accounting Completion: The café's point-of-sale system records the completed transaction, and the merchant can now access these funds.

A Tale of Two Timelines

One of the most fascinating aspects of this process is how it reconciles two fundamentally different settlement timeframes:

The Blockchain Side: Maria's USDC was locked instantly and transferred within minutes on the Linea blockchain.

The Traditional Finance Side: While the authorization was instant, the actual settlement between banks took 1-3 business days.

This temporal mismatch is managed by the financial intermediaries (Baanx and Monavate), who effectively "front" the money to the traditional financial system while waiting for their crypto assets to be fully converted and settled.

The Pragmatic Reality of Intermediaries

Satoshi Nakamoto's original vision for Bitcoin described a purely peer-to-peer electronic cash system where only two parties would participate in a transaction. This vision of disintermediation — removing all middlemen — remains a powerful ideal in the crypto community.

Yet the reality we see in the crypto card payment flow reveals something more nuanced: intermediaries exist for a reason. Each of the 15 distinct intermediaries in this complex dance serves a specific purpose in bridging the gap between the crypto ecosystem and traditional finance.

This isn't a failure of crypto's promise — it's a pragmatic recognition that different systems have different strengths. Traditional payment networks excel at merchant acceptance and consumer protection. Blockchain excels at final settlement and programmable money. Combining them requires translation layers.

Even in a future with purely crypto-native transactions, we'll still need various intermediaries for specific business functions: identity verification, dispute resolution, fraud prevention, regulatory compliance, liquidity provision, and user-friendly interfaces. The form and number of these intermediaries may change, but their functions remain necessary for a system that can serve billions of people with diverse needs.

Open Loops vs. Closed Loops

The current crypto card system represents a step toward what I've previously described as Open Loop Networks for crypto currency payments.

Most crypto payment volumes today remain in closed loops — siloed ecosystems where users can only transact within the boundaries of a specific platform or exchange. This mirrors the early internet era of AOL and CompuServe, where users could only interact with others within their chosen walled garden.

Crypto cards begin to break these walls down by connecting crypto assets to the open payment networks of Visa and Mastercard. However, the ultimate goal should be even more ambitious: truly open networks where stablecoin payments can reach beyond the current trillion-dollar cryptocurrency market to address a meaningful portion of the $190 trillion global payments flow.

This won't mean eliminating all intermediaries — it will mean creating standardized, interoperable messaging systems like TAP, where intermediaries add value rather than creating closed gardens. The most successful financial innovations don't remove all friction; they relocate it to where it causes the least harm while preserving necessary functions.

Who Pays for All This Magic?

You might wonder how this complex system stays economically viable. The costs and fees are distributed across multiple points:

Maria may pay a small card issuance fee and a foreign exchange spread when her USDC is converted to euros.

Monavate earns a portion of the interchange fee that Mastercard charges on every transaction.

Baanx takes a slice of the interchange fee and may also earn on the currency conversion spread.

The café is paid minus the merchant discount rate to SumUp (around 1.5% of the transaction).

SumUp keeps most of that merchant fee after paying its acquiring bank.

Mastercard collects network fees from both the issuing and acquiring sides.

This distribution of fees across the value chain is what makes the bridge between crypto and traditional finance economically sustainable.

The 17 Participants: Mapping the Full Chain

To fully appreciate the complexity of this system, let's identify every participant involved in Maria's simple coffee purchase:

Cardholder (Maria) – The MetaMask user who owns the USDC and initiates the payment

MetaMask Wallet / ConsenSys – The self-custody wallet provider that fronts the card experience

Linea – The Layer 2 blockchain where Maria's USDC is held

Circle – The issuer and reserve manager for USDC stablecoin

KYC/AML vendor – Identity verification provider that onboarded Maria

Baanx – Program manager and processor that bridges crypto to cards

Monavate Ltd – Mastercard principal member and e-money institution that issues the card

CompoSecure – Physical card manufacturer

Liquidity provider / exchange desk – Converts USDC to fiat currency

Mastercard Network – Routes authorization messages and settles between parties

Issuer-processing platform – The tech stack that approves/declines transactions

SumUp POS device – The payment terminal at the café

SumUp (Payment Facilitator) – Aggregates merchants and routes transactions

Acquiring bank / processor – SumUp's Mastercard member that receives settlement

SEPA network – European payment rail for the final merchant settlement

CaixaBank – The café's bank where the funds ultimately arrive

Coffee-shop merchant – The business receiving payment

Notice that participants 1-5 are primarily crypto-side entities, while participants 6-17 are predominantly traditional finance entities or bridges between the systems. In other words, 12 of the 17 participants in this chain exist primarily on the traditional finance side or as bridging entities.

Another way of looking at it is that the first 10 participants after Maria represents her on the consumer side and the next 5 represent the merchant side.

The Streamlined Future: Full Open Loop Stablecoin Payments

It's worth comparing this complex flow to what a true open-loop, direct stablecoin payment might look like in the future. In such a system, a customer could simply:

Scan a merchant's QR code with their crypto wallet or use an Apple Pay like method to sign a payment request by tapping the phone on of the new breed of crypto capable POS'.

Approve sending USDC or another stablecoin directly to the merchant's wallet provider or PSP who handle fraud and ensure the funds are safe

Complete the transaction with final settlement in seconds

Maybe the 10 participants representing Maria could get squeezed down to 3 or 4 and perhaps just 2 on the merchant side. This would radically lower costs and risk for stablecoin payments over the way it’s done in traditional networks.

With the right regulatory framework and standards, a future stablecoin transaction might involve as few as 5-7 participants instead of 17.

The remaining intermediaries would primarily focus on essential services like:

Identity and compliance verification

Dispute resolution and consumer protection

User interface and experience design

Security and fraud prevention

This streamlined approach is the ultimate promise of open loop stablecoin payments - maintaining necessary functions while eliminating redundant layers. The $190 trillion opportunity isn't just about moving current transaction volumes to blockchain; it's about creating more efficient payment systems that reduce costs and friction for everyone involved.

Why This Matters: The Bigger Picture

This intricate dance between blockchain and traditional finance represents far more than a convenient way to spend crypto. It demonstrates how technological bridges can connect fundamentally different financial paradigms without requiring everyone to adopt new systems simultaneously.

The merchant doesn't need to understand blockchain or accept cryptocurrency directly. Maria doesn't need to convert her crypto to fiat before spending. The payment terminal doesn't need special crypto capabilities. Everyone operates in their native financial environment while the complex translation happens invisibly in the background.

This approach solves the classic chicken-and-egg problem of new payment technologies:

Merchants won't accept new payment methods without consumer demand

Consumers won't adopt new payment methods that aren't widely accepted

Nobody wants to learn completely new behaviors for everyday transactions

By leveraging existing card networks as the interface, crypto payment solutions like the MetaMask Card create an evolutionary rather than revolutionary path to blockchain adoption in everyday commerce.

The Future Is Already Here

What's most remarkable about this 18-step journey is that it's not a theoretical future scenario—it's happening thousands of times daily around the world. Crypto cards from MetaMask, Coinbase, Binance, Crypto.com and others are processing millions of dollars in transactions, quietly building the bridge between blockchain technology and everyday commerce.

As this infrastructure matures and becomes more efficient, we'll likely see:

Reduced fees as competition increases and processes are optimized

Faster settlement as traditional financial rails are upgraded

More sophisticated smart contracts that enable programmable spending rules

Greater merchant awareness and dedicated crypto acceptance options

For now, though, there's something almost poetic about how these two financial worlds—one centuries old, one barely a decade in existence—have found a way to communicate through the simple tap of a card on a terminal.

The next time you use your crypto card to buy a coffee, take a moment to appreciate the remarkable invisible journey your digital assets are about to undertake. That beep from the terminal isn't just confirming a payment—it's announcing the successful navigation of one of the most sophisticated financial translations ever created.

This article breaks down the complex process of how crypto cards work, based on the MetaMask Card as an example. The exact process may vary slightly between different card programs and regions, but the fundamental bridge between blockchain and traditional finance remains conceptually similar across implementations.

18 new bosses same as the 18 old bosses.